HF Markets or HFM (previously known as HotForex) is a well-known name in the industry that has more than 10 years of experience under its belt, as well as a whole lot of awards. Over the years, the broker has won more than 55 industry awards recognizing it as Most Transparent Broker at the 2020 Global Banking & Finance Review Awards, Best Forex Broker Africa 2021 by The European, Best Forex Mobile Application by the Global Brands Magazine 2021, just to name a few.

The broker has carved out its presence in a wide variety of markets – Europe, Asia, and Africa, with main operations running from Cyprus. In Europe and the UAE, the broker goes by the name of HF Markets.

HFM regulation and security of funds

HFM is a part of HF Markets Group with operations in numerous jurisdictions worldwide. Here is a list of the main companies within the group and their licenses with the relevant authorities in each of the countries:

| Company | Country | Regulation |

| HF Markets (Europe) Ltd. | Cyprus | CySEC |

| HF Markets (UK) Ltd. | UK | FCA |

| HF Markets (DIFC) Ltd. | UAE | DFSA |

| HF Markets SA (PTY) Ltd. | South Africa | FSCA |

| HFM Investments Limited | Kenya | CMA |

As you can see, the broker is licensed by some of the most respected financial authorities – the UK’s Financial Conduct Authority (FCA), and the Cyprus Securities and Exchange Commission (CySEC). Let us explain what these licenses mean for clients of HFM /HF Markets.

EU & UK Regulation

If you are based in Europe, you have the chance to work with HF Markets EU or HF Markets UK – the most heavily regulated entities within the HFM group. Here are the most important things you should know about forex regulation in these jurisdictions.

First off, clients of the EU and UK branches of the broker may rest assured that their funds are held in segregated accounts – which ensures that there will be no commingling of customer assets with the company’s operational capital. Secondly, they can trade with the ease of mind that they won’t lose more money than they have initially deposited – because of the negative balance protection policy CySEC and the FCA maintain.

Besides, these top regulators provide significant assurances that brokers under their gaze won’t manipulate the prices by requiring daily reports on open and closed trades.

As an additional safeguard clients of HFM in Europe are covered by a compensation scheme or fund in the unlikely event that the broker goes under and cannot pay them back. The broker’s Cypriot branch can cover up to 20,000 EUR, while the UK entity may guarantee up to GBP 85 000 in compensation.

UAE regulation

If you are based in the Gulf region and wish to open an account with HFM, your best bet would be the Dubai branch of Hot Forex – HF Markets DIFC, which holds a license with the DFSA.

The Dubai Financial Services Authority (DFSA) is probably the most well-known regulator in the Middle East. It works alongside the Dubai International Financial Center (DIFC), which acts as an exclusive economic zone for companies dealing in the financial sector.

DFSA-licensed brokers are obliged to follow certain rules, most of which are related to the Sharia laws. Most specifically, they should only offer swap-free accounts. With these, no interest is paid on overnight positions, however, traders are usually charged with additional account fees. Also, brokers licensed in Dubai are restricted in terms of leverage – they cannot offer more than 1:30.

South Africa & Kenya regulation

HFM is also present in Africa, having regulated subsidiaries in two of the most developed countries on the continent – South Africa and Kenya. Clients of HFM in these countries aren’t offered the protections European customers of the broker enjoy, but still, they are supposed to receive the same level of transparency, as well as to be guaranteed segregation of their money from the company’s operating funds.

Other licenses and registrations

Apart from its subsidiaries in the UK, EU, UAE, Kenya, and South Africa, HFM also has several offshore subsidiaries in Saint Vincent and the Grenadines (SVG) and Seychelles.

Brokers in these offshore zones are formally licensed or only registered, but in this case, this shouldn’t bother you at all. The broker belongs to an international – HF markets Group – group whose members to name a few.

The truth is, HFM is taking advantage of the looser regulations outside of Europe and the UAE because this allows it to offer bonuses and high leverage many traders find attractive. This is why almost all major forex brokers have offshore subsidiaries.

In Europe, on the other hand, there are many restrictions that prevent brokers from offering high leverage, bonuses, and so on. These restrictions are basically aimed at consumer protection but if you would still prefer to access some of the advantages the EU or UK branches of HFM could not legally offer you, the offshore entity of the broker is a good option.

HFM trading conditions

HFM Minimum deposit

| HFM branch | HF Markets EU | HF Markets UK | HF Markets DIFC | HFM SA |

| Min. deposit | $0 EUR | $0 GBP | $0 AED | $0 ZAR |

As you can see from the above table, HFM doesn’t have a high entry threshold – it’s basically 100 currency units for its clients in Europe and the UAE, and $5 for those in the other jurisdictions. Note that we are talking about the minimum deposit of the broker’s most basic account types.

HFM Leverage

| HFM branch | HF Markets EU | HF Markets UK | HF Markets DIFC | HFM SA |

| Max. leverage | 1:30 | 1:30 | 1:400 | 1:2000 |

Overall, HotForex is quite generous with leverage, offering levels as high as 1:2000, provided that there aren’t regulatory restrictions in this regard. And as you can see, such restrictions apply in Europe and the UAE – therefore the broker cannot offer leverage higher than 1:30.

What leverage does is increase your trading potential. For example, if you have invested $100 and trade with a leverage of 1:500, you could trade with a capital of $50 000. Such big offers can indeed lead to huge profits in no time at all, but if you don’t have sufficient experience and knowledge, more often than not high leverage would lead to crippling losses. That is why most financial regulators have imposed restrictions on the leverage brokers could offer to retail clients.

HFM spreads

| HFM branch | HF Markets EU | HF Markets UK | HF Markets DIFC | HFM SA |

| Avg. EUR/USD spread | 1.2 pips | 1.3 pips | 1.3 pips | 1.3 pips |

Furthermore, the broker offers comparatively low spreads, floating around 1.2 pips on EUR/USD, which is average. According to us, the conditions on the Zero spread account are the most attractive ones: spreads starting from 0 pips and a commission of $3 per standard lot traded (per side). And you can open a Zero spread account with just $200.

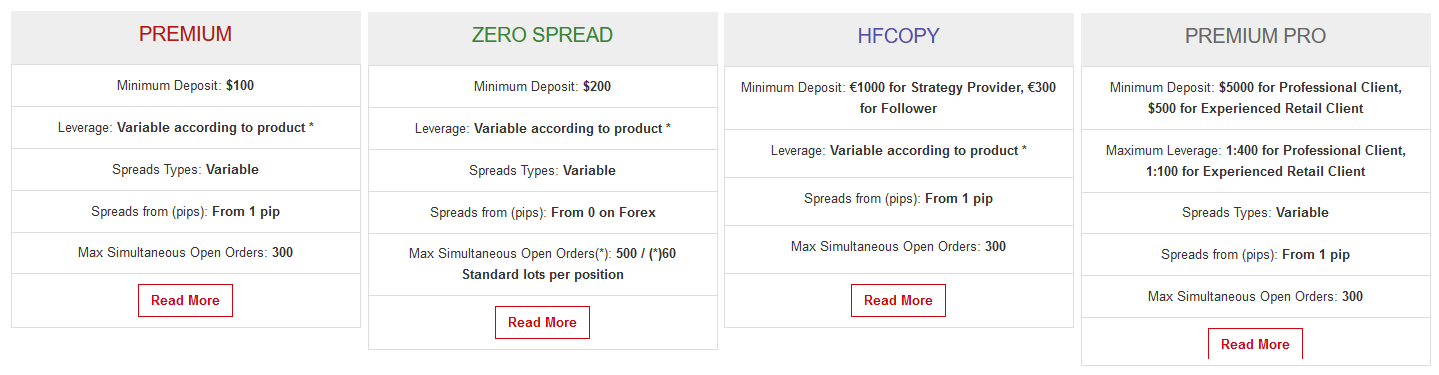

HFM trading accounts

The trading accounts HFM offers also differ, depending on the jurisdiction. Overall, clients of the broker in Europe and the UAE are offered four account types, which you may take a look on the screenshot below:

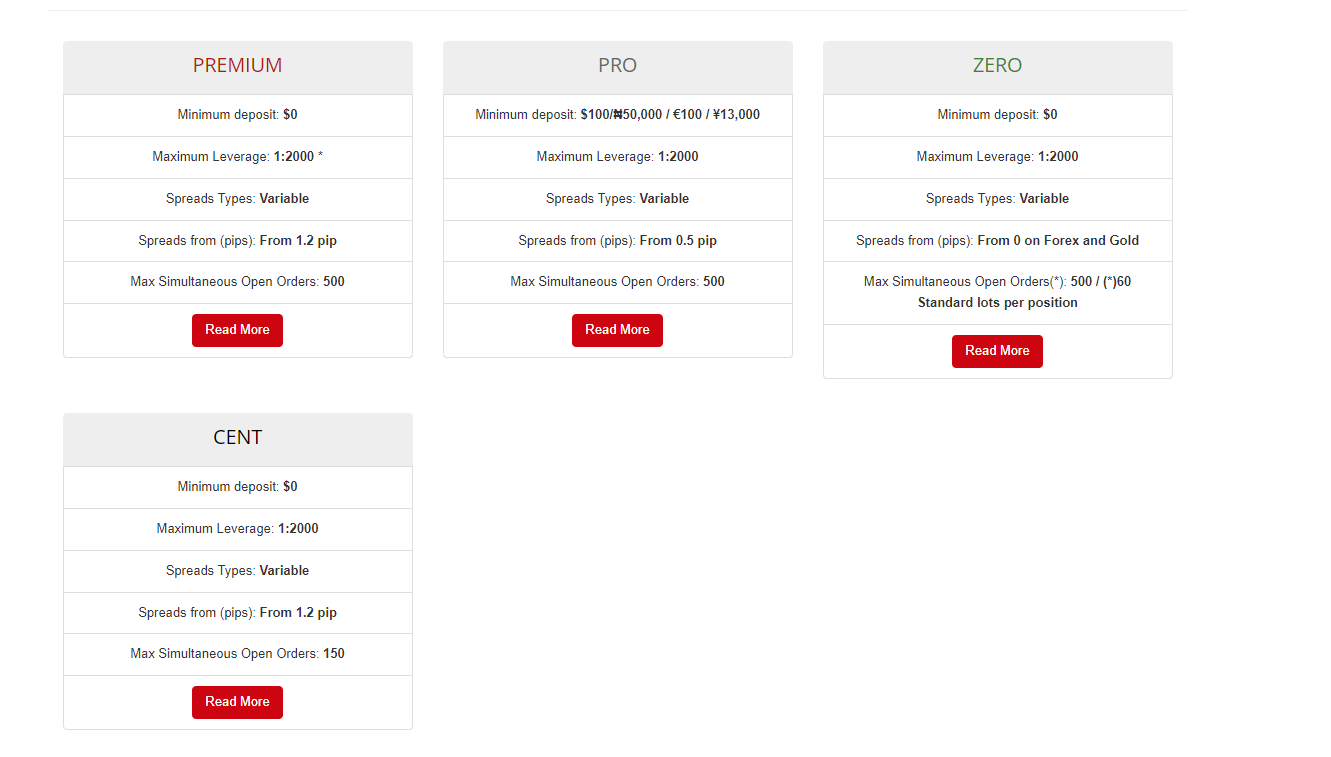

HFM traders, who have joined the platform outside the EU or the UK, are now offered a number of new account types to choose from – Premium, Pro, Zero and Cent.

A major perk is the generous leverage of up to 1:2000, available with all four account types, as well as the symbolic minimum deposit requirement.

With the Premium, Zero and Cent accounts you can start trading with virtually 1 USD, the Pro account being the sole exception, as you are expected to deposit just 100 USD.

Spreads look pretty attractive too – you can easily expect that from a broker with the reputation of HFM – starting from virtually zero pips with the Zero Account, from as little as 0,5 pips with the Pro Account and from 1,2 pips with the Premium and the Cent Accounts.

The Zero Account however, comes with a minimal trading commission in the amount of just 3 USD per standard lot per side traded, which basically adds another 0,6 pips to the equation.

On top of that the Premium, the Pro and the Zero accounts allow traders to maintain up to 500 simultaneous open orders. With a Cent account the number is limited to 150, but that looks pretty generous as well.

All account types are available on a MetaTrader4 or a MetaTarder5 platform.

HFM trading platforms

This broker supports both MetaQuotes’ platforms: the standard MetaTrader4 (MT4) and the latest MetaTrader 5 (MT5).

MT4 is an internationally acclaimed trading terminal, offering a full spectrum of trading tools and resources: built-in technical indicators, an advanced charting package, a wide range of Expert Advisors (EAs), and extensive back-testing options for them. Traders can download ready-made or create their own EAs and let the program do all the work, with no human emotions involved.

MetaTrader 4 is available to clients of HFM as desktop, web, and mobile versions.

The MT5, on the other hand, was intended as a multi-asset trading platform. In addition to forex, it facilitates trading in exchange-traded stocks. The platform is generally an enhanced version of the MT4, keeping most of the functionalities of its predecessor – excellent charting, Expert Advisors, and more. Of course, the MT5 has more chart tim frames and order types in store for traders than the previous version.

Besides, free VPS hosting is offered to both new and existing customers who deposit a minimum of $5,000 and maintain this amount for the subsequent months. VPS hosting allows running auto-trading strategies and execution of orders 24 hours, 5 days a week.

Apart from MetaTrader 4 and MetaTrader 5, the broker offers a unique copy-trading system called HFcopy.

If you don’t have much experience with online trading or you simply don’t have the time to trade, you can simply follow and copy the trades of professionals (Strategy Providers). As an investor at HFM ‘s system, you have means of control over your trades – for example, you can copy only a percentage of the Strategy Provider’s trades, or set a rescue level that allows you to keep a fraction secure in case of loss. Of course, you can also unfollow a Strategy Provider at any time.

HFM Promotions

As we noted already, trading bonuses and other promotions are only available to clients of HFM outside Europe and the UK. Currently, the broker offers three types of trading bonuses – 100% supercharged bonus, 100% credit bonus, and 30% rescue bonus, a Loyalty program with 4 different reward levels, and various contests with attractive rewards.

100% supercharged bonus

This promotion allows you to earn daily cash rebates of USD 2 per lot up to USD 8,000 directly to your account. It applies to every deposit of USD 250 or more.

Note that this bonus scheme is for trading purposes only and cannot be withdrawn.

100% credit bonus

This bonus applies on new deposits or internal transfers to Micro, Premium, and Islamic accounts of at least 100 USD (up to a maximum of 30,000 USD).

The bonus can be withdrawn if volume requirements are met – read the Terms and Conditions for further information.

30% rescue bonus

This is a sort of Rescue Program that applies to deposits over USD 50 and increases the leverage on your account.

Note that the maximum leverage available on Micro Accounts to which the Rescue Program has been applied is 1:500, and the bonus can be withdrawn if volume requirements are met.

In addition to these bonuses, HFM also has a Loyalty program with 4 different reward levels. It’s simple: The more you trade, the more Bars you earn, and you can exchange them for credit bonuses, cash, or trading services.

HFM methods of payment

HFM supports a wide range of payment methods: credit/debit cards (Visa, Visa Electron, MasterCard, Maestro, American Express), bank wire transfer, and e-wallet payment systems Skrill, Neteller, WebMoney, FasaPay, iDEAL, Load, and BitPay.

The payment methods the broker works with vary depending on the location, but almost all deposits and withdrawals are free of charge.

Bottom line

HFM is a classic example of a well-established and thoroughly regulated international broker that offers a wide range of trading products and account types under competitive conditions. So, don’t hesitate and check out their website and test their services for free today.

Here are, once again, the main advantages and drawbacks with regards to this broker:

| Pros | Cons |

| Solid regulation in various jurisdictions | Not any significant |

| Competitive trading conditions | |

| Both MT4 & MT5 available | |

| Attractive bonuses & promotions |

I just wonder what is happening to the CFX Group? I couldn’t make any withdrawal. I did research and found that Mustang Tech could help victims to recoup assets and I reached out to them and they helped recoup my investment from CFX Group. Victims who are also trying to recoup their assets can contact http://mustanggg. com for help.

I was scammed by this company, they made me invest huge amount and when time for me to withdraw my money they asked another fee, stop responding to my chat after refusing to pay, but thanks to mrs lilo grace who l contacted on ” lilo__grace__75_( @ )_gmail_._com )” | report my case on how I was scammed by this broker , in less than 4 days I got a letter for full refund from this broker, like right now all my money have successfully been recovered back to my bank account, you can also contact on whatsapp:+1 ( 615 )-414-15-62