A broker like FXTM hardly needs an introduction – the company has received wide recognition, not only from its clients, but the industry itself. It boasts more than three million clients across the various iterations of the broker and a plethora of prestigious awards. For example, in 2021, the FXTM brand received the World Finance Best Trading Experience reward. What’s more, the company has received that very award every year since 2019 without fail.

FXTM is a stellar brokerage, no matter the kind of trader you are. Whether you are a new client on the markets, or an experienced and savvy professional, we are sure FXTM has something for you! And if you wish to discover what that is, check out the full review of the firm below – in it, we have expanded on every last aspect of it!

The Company. Regulation and security of funds

As an industry leading brokerage, FXTM takes a very strict approach to its regulation. The company has been on the markets since 2011 and it has continued to strive to higher safety for its clients by obtaining various licenses around the world. In the section below, we have outlined the various trading names of the company from around the world and the authorities which regulated them. We have then expanded on what each of these licenses means for you. Finally, we have outlined some of the bigger branches of the company from emergent markets: Nigeria, Malaysia and Indonesia.

Regulation is a very crucial aspect when it comes to Forex brokers, and we have outlined the basics of the regulatory regimes FXTM follows in the table below:

| FXTM Trading name | Jurisdiction | Regulatory body |

| Exinity UK Limited | The United Kingdom | Financial Conduct Authority (FCA) |

| ForexTime Ltd | The European Union | Cyprus Securities and Exchange Commission (CySEC) |

| ForexTime Limited | South Africa | Financial Sector Conduct Authority (FSCA) |

| Exinity Limited | Mauritius | Financial Services Commissions Mauritius (FSCM) |

With such a high number of licenses, it is clear that the broker is operating with strict governmental oversight. It is also a member of FinaCom, a Hong-Kong based NGO whose main purpose is resolving disputes from the Forex markets from around the world.

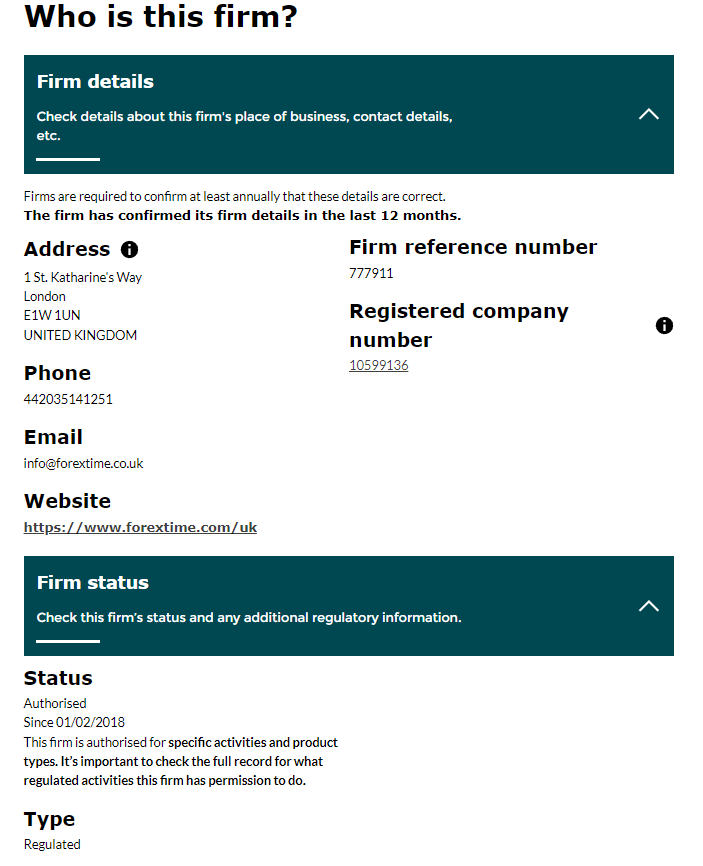

FXTM’s FCA license

We will begin examining the regulatory framework the company follows with its UK trading name. This is Exinity UK Limited, and the firm has been a member of the FCA register since it first obtained the license shown below in 2018.

The FCA is a notoriously strict regulatory body – and there are high protections for the funds of the retail client who wishes to trade there! These include, among others, access to a beneficial compensation scheme. All brokers with FCA licenses are required to participate in guarantee funds – if a broker within that network goes under, its retail clients are entitled to up to £85 000 worth of compensation. This way, their money is protected from the violent fluctuations of the markets. Of course, this is just one example of the benefits there are to trading with UK brokers – there is also access to a Negative Balance Protection and various scam prevention measures.

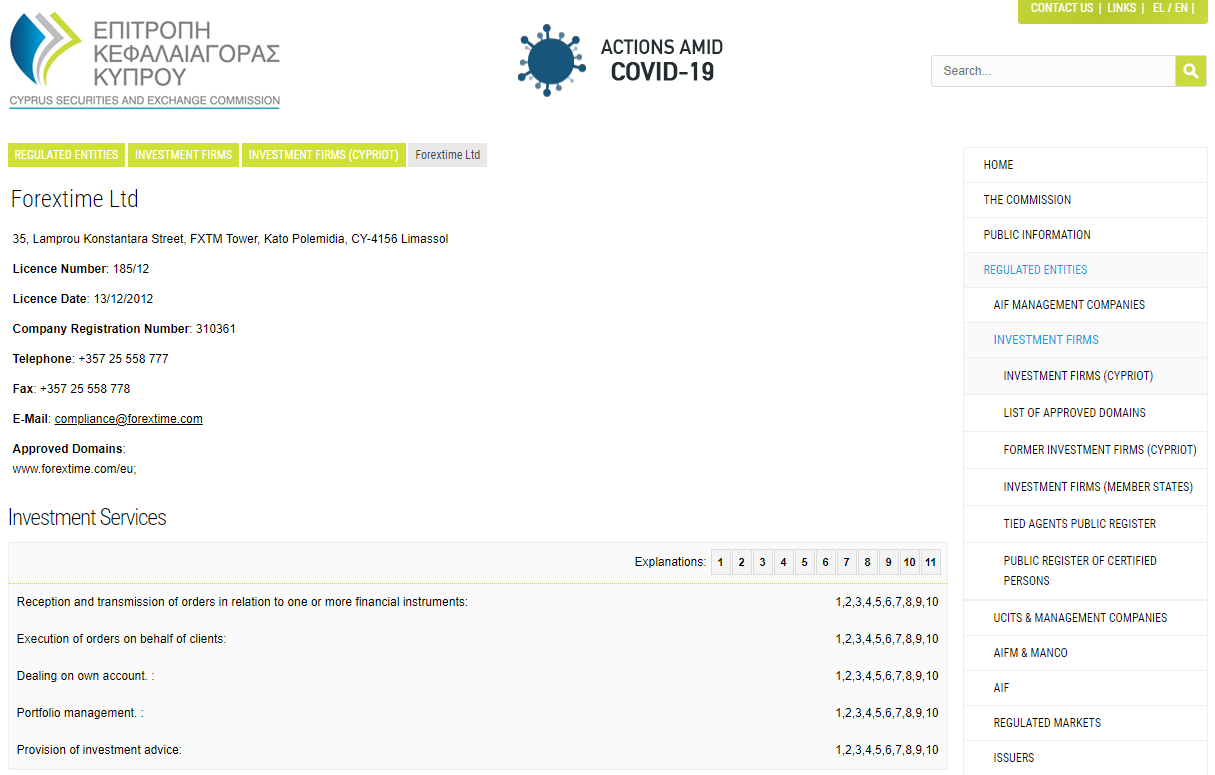

FXTM’s CySEC license

The next license we would like to cover is the one that FXTM has obtained from the CySEC, under the trading name ForexTime Ltd. This is the first major license the firm obtained, all the way back in 2012 – and what a way to get stated with a bang! Cyprus is one of the most important markets in the EU, and the regulatory body that watches over it is widely considered to be the seat of the European Union’s regulation on the markets. Of course, here is the license FXTM has from the regulatory body, available on the register of the CySEC:

There is a specific feature of a license from an EU regulatory body – and that is the fact that the companies who hold a license with any one of these regulators can get registered with the other ones within the Union – this is because the regime of all member-states is unified. This has enabled FXTM to provide its services to other countries within the EU – most notably, the broker is also registered with the BaFIN in Germany, the CONSOB of Italy, the FSAN in Norway, the AMF in France and so on.

If you are wondering what the regulatory framework in the EU is, it is quite similar to the one in the UK. In the following table, we have outlined the major protections these different jurisdictions provide access to:

| Regulatory protection | European Union | United Kingdom |

| Access to guarantee funds on broker default | Up to €20 000 | Up to £85 000 |

| Negative Balance protection | Provided | Provided |

| Client account segregation | Provided | Provided |

| Minimum capital requirement on brokers | Provided | Provided |

These similarities are such because of the past of the UK as a member-state. However, the regime clearly works, as Britain retained in after its exit from the Union, only expanding on it!

FXTM’s FSCA and FSCM licenses

There are also two other license that FXTM holds. These are its license from South Africa, where FXTM is regulated as ForexTime Limited, and its license in Mauritius, where the company is known as Exinity Limited. Even though these trading names are similar to the ones examined above, the regulatory regimes they operate in could not be different! South Africa and Mauritius are among the strictest regulatory bodies in the whole continent of Africa, but they are not particularly demanding when it comes to restricting the brokers under their oversight.

For example, companies licensed within the EU and UK cannot provide any amount of leverage they want to to the retail client – only amounts of up to 1:30 are allowed. We will expand on this a bit later, but for now it suffices to say that the relatively lax regime of these regulatory bodies directly translates to some rather beneficial trading conditions for you, the company’s client! What’s more, the vast majority of FXTM branches are operated by Exinity Limited, the Mauritian firm. We would also like to mention that there are no Negative Balance policy and access to guarantee funds available – so we recommend only experienced traders make use of the services of these FXTM offshoots.

And the issues, typically associated with brokers from these two countries are not present with FXTM – the company’s liquidity is guaranteed by the fact it is one of the market leaders out there. If you need an easier way to visualize the differences in the regulatory frameworks of the different branches, check out the table below:

| Regulatory protections | The European Union | The United Kingdom | South Africa | Mauritius |

| Access to guarantee funds | Yes, up to €20 000 | Yes, up to £85 000 | No | No |

| Minimum capital requirement for brokers | From €730 000 | From €730 000 | Not required | From $25 000 to $250 000 |

| Access to Negative Balance Protection | Yes | Yes | No | No |

| Client fund segregation | Required | Required | Not required | Not required |

| Leverage restriction | Up to 1:30 for retail clients | Up to 1:30 for retail clients | Not limited | Not limited |

The FXTM branches around the world

Far from being content with offering its services in countries in the EU, the UK and in Mauritius and South Africa, FXTM has expanded to the markets of Asia and Nigeria. These branches of the company provide access to some interesting features, which we will outline below, and show the commitment of the company to providing access to a tailor-made experience to its client, no matter where said client is located.

One thing to note before we continue, is that all of these branches are run by the Mauritian trading name of the company – so refer to the section on it to see what regulatory rules the companies follow!

FXTM Nigeria

Nigeria is one of the main places where FXTM turns its attention. And that is for a good reason – the country has a staggering population of 206 million people at the time of writing, and is quickly developing. The markets in Nigeria are dominated by FXTM – the company has received several awards dubbing it the best broker there, with World Finance Magazine granting FXTM the award in 2020 and in 2021.

The broker is so famous because it offers some rather exciting features to its Nigerian clients. One of them is the ability for them to deposit in the Nigerian Naira directly – the domestic currency of the country. What’s more, FXTM offers them a very generous fixed exchange rate on the Naira, which is quite beneficial with the rather fluctuant currency. Nigeria has a bad reputation for its high number of scammers, and if you are a reader from there, we implore you to stick to large brokerages like FXTM instead of trusting smaller and unlicensed companies!

FXTM Malaysia

Another market that is often underestimated by other global brokerages is the Malaysian one. However, FXTM has a branch dedicated to it as well. The website of that company is entirely in the native tongue of the country, thus better empowering its citizens to make use of the excellent trading conditions FXTM Malaysia has in store for them! We have outlined said conditions a bit later on, but we assure you, they are truly competitive. Therefore, we can only recommend the broker to readers from the country!

FXTM Indonesia

Lastly, we would like to mention FXTM’s Indonesian branch. The company once again offers access to clients from a traditionally underrepresented market. And, once again, not only does it do so at premium trading conditions, but offer them specific, tailor-made features to make their trading as easy and as lucrative as possible.

One of these is the access to deposits in Indonesian rupees directly – without having to deal with pesky transfer fees that eat away at your deposits. The payment methods FXTM Indonesia provides are also tailor-made for clients from the country, with the broker accepting their deposits via local bank wire transfers! With a broker like FXTM, every Indonesian client is bound to be satisfied!

Promotions

With the regulatory frameworks FXTM follows and its various offices around the world examined, it is time to take a look at the special promotions the company allows its clients to participate it. Do note that these promotions are available to clients of the Mauritian firm only – the EU and the UK have actually banned the provision of such bonuses and incentives entirely! The regulatory bodies do have their reasoning to restrict the availability of the promotions, of course – but luckily, clients of Exinity Limited can still make use of them!

Here is a handy table with the two main trading bonuses FXTM offers:

| Bonus name | Bonus specifics |

| $50 referral bonus | Refer friends and family to FXTM for a $50 bonus! |

| Forex trading contests | Trade and compete with others to win attractive prizes! |

We will go into more detail on how the bonuses function too – but it is worth remembering they come with additional Terms and Conditions. Make sure you get familiar with them too before accepting one of the promotions!

The referral bonus is available to any client of FXTM who has opened an account with the company. The bonus is available on account creation and you can refer others to FXTM via a unique personal referral link to claim further $50 bonuses, once their trading volume reaches a certain size.

One of the most exciting promotions FXTM runs is the Forex trading contests. There are two kinds of these contests – there are demo ones, where no real money is at stake and every participant uses one of FXTM’s demo accounts, and there are the real ones, which feature trading with one’s own funds.

The goal in both of these contests is to reach the highest trading volume, with the winners being presented with some excellent rewards. There are also solo and team based competitions too – FXTM has something for every type of trader!

Trading Accounts and minimum deposits

FXTM is a very flexible broker, that is dedicated to providing a unique experience to traders of all kinds of backgrounds and ones that are willing to deposit various amounts of money. Therefore, the company does not offer one, but three account tiers. Furthermore, the various regulatory regimes FXTM follows determine some differences in the company’s different account tiers. We will expand on all of this below, starting with the various account tiers the UK branch of the company offers access to, visualized for your convenience in the table below:

| Trading account tier and minimum deposit | Micro Account – $/€/£ 50 | Advantage Account – $/€/£ 500 | Advantage Plus Account – $/€/£ 500 |

| Who should use this account? | Novice traders or ones looking to gain experience trading | Traders looking to make use of fixed spreads | Traders who prefer floating spreads and zero commissions |

The three main account tiers FXTM UK offers are the Micro, the Advantage and the Advantage Plus accounts.

The Micro account offers access to novice traders to the markets, at a very low point of entry. They are an excellent starting point and a way to determine if Forex trading is right for you, or even a way for you to gain experience on the markets. The Advantage Account is priced at a higher point, with it also providing access to fixed spreads. Also, more asset classes are available with Advantage accounts – micro account owners can only trade FX assets and metals, while Advantage Account owners can make use of Indices and Commodity assets as well. Finally, the Advantage Plus account differs from the Advantage one because it offers access to the same assets, but traded on floating spreads!

The accounts with FXTM EU are quite similar. The only significant difference is the lower price of the micro account – it starts from $/€/£ 10, making it even more accessible to newer traders. The account tiers of the South African FXTM branch follow the conditions of the EU tiers.

Finally, the account tiers with Exinity Limited, the Mauritian FXTM branch are identical in pricing to the ones the European branch offers. The only notable difference is the higher amounts of assets available to their clients – they have access to all the same assets as the other clients, but can also trade Stock baskets and CFDs. And for Nigerian clients who can open their account tiers using their own currency, the Naira, the broker offers the following pricing model: ₦10,000 for Micro account; ₦80,000 for Advantage account; ₦80,000 for Advantage Plus account.

Demo accounts are available with the broker too – so if you are interested, you can set one up for free and see for yourself what kind of service FXTM has available.

Trading conditions: Leverage, spreads and commissions

FXTM offers access to some of the best trading conditions out there. The broker takes special care to provide its clients with only the best leverage, and the lowest spreads and commissions possible. Once again, the various branches of FXTM have various different services available. And once again, we will cover them in more detail below, staring with the leverage FXTM has available:

High-leverage trading is a rather contentious issue. There are a lot of clients who are just not equipped to deal with the higher risks of such a trading mode – but there are also experienced traders who make a great use of it to multiply their investments. To that end, there are various differing regulatory frameworks on leverage. The regimes FXTM follows are outlined in the table below:

| FXTM branch | FXTM UK | FXTM EU | FXTM South Africa | FXTM Mauritius |

| Maximum leverage Amount allowed for retail clients | 1:30 | 1:30 | 1:2000 | 1:2000 |

| Maximum leverage Amount allowed for professional clients | 1:2000 | 1:2000 | 1:2000 | 1:2000 |

The distinction between a retail client and a professional one is another part of the regulatory regime of the Union and the UK. A professional client is one that has a certain amount of money in their portfolio – over €500 000. It is also possible to become a professional trader if you achieve a trading volume of over 10 lots annually with the broker.

And if you are looking to trade with one of the other branches of the broker, branches that offer higher leverage amounts, you will be allows to select what amount you feel is right for you, so make sure to do so. Only trade with high leverage if you know you have what it takes to mitigate the risks that come from it! If you are ready to reap the rewards of high leverage, however, FXTM is the right broker for you.

| Feel the thrill of trading. No Deposit. No risk. |

On to the charges of of the broker – typically, companies make their money one of two ways – they either charge their clients an upfront commission on open and closed trades, or have them pay the value of the spread between the buy and sell price on an asset. Both of these charge models are available with FXTM – but the broker does not tax its clients with both of them at once – the Micro and the Advantage Plus account tiers are spread-based, with the average spreads starting from 1.5 pips on them. The Advantage account is commission based – clients pay between $0.4 and $2 per traded lot.

Whichever way you chose to trade, the conditions FXTM offers are incredibly competitive and worthwhile – trading with the company is surely worth your time and money!

Trading platforms

FXTM provides access to two of the best trading platforms out there. The company has a distribution of both Metatrader 4 and Metatrader 5, the two pieces of software that have changes the markets forever, readily available. Please note that clients from the UK can only make use of the Metatrader 4 platform, as FXTM does not offer MT5 to them. However, there is nothing wrong with MT4 – in fact, the platform, depicted below, still has the higher number of accounts open on it from the two!

As we said, the platform has truly changed the markets – that is because it has a unique combination of clean software and powerful analytical tools. MT4 also allows access to automated trading, which is quite beneficial for the inexperienced retail client. It is done with “expert advisors” – trading bots that can be purchased from the vibrant marketplace the platform has available. And the successor of the platform, MT5 has taken the winning MT4 formula and refined it further. Here is what the platform looks like:

Whichever platform you pick, you will be in good hands with FXTM – the broker not only has the software available, but also provides access to the excellent trading conditions mentioned above.

Copytrading

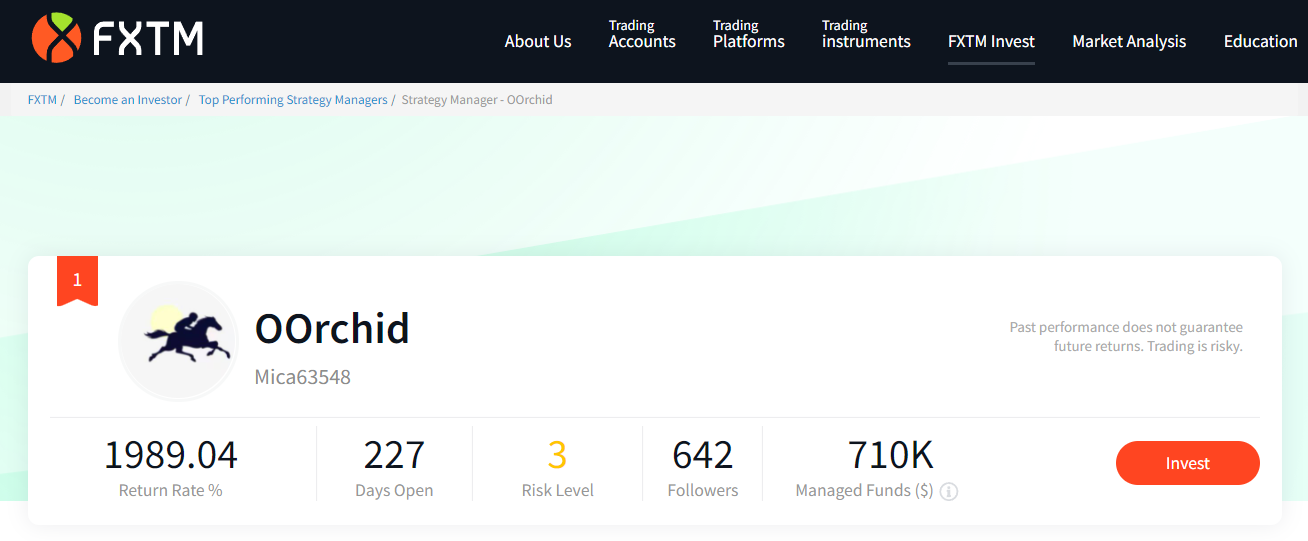

FXTM is one of the brokers that also offer access to copytrading, which is a unique feature that allows new clients to benefit from the markets without needing an intimate knowledge of it. The broker has the feature available to clients of Exinity limited – the Mauritian branch of the company.

The feature allows traders who are looking for guidance to start copying the account of another trader – a master account. Here is one of these master accounts:

When the trader behind the master account opens a trade, the account copying it will also open the same trade. The price of that service is assigned by the master trader – and it usually ranges between 20 and 30% of the value of the trader.

Deposit methods

FXTM accepts various payment methods – the availability of them depends on the branch of the company you aim to trade with. We have outlined the major payment methods with each one in the following table, for your convenience:

| Payment method | Accepted by FXTM UK | Accepted by FXTM EU | Accepted by FXTM South Africa | Accepted by FXTM Mauritius |

| Credit Card | Yes | Yes | Yes | Yes |

| E-wallets – Neteller, Skrill | Yes | Yes | Yes | Yes |

| Crypto assets | No | No | Yes | Yes |

| Wire transfers from domestic banks | Yes | Yes | Yes | Yes |

All of these payment methods have various unique features that might make a client prefer them. Payments via credit card are usually preferred, but could be rather limited in size. In contrast, payments using a bank wire are virtually unlimited in size but quite slow. E-wallet payments and crypto ones are quite novel and certainly have their plusses and minuses – e-wallets are easy to top up at any time and quite convenient to use, and crypto payments are irreversible, which can be somewhat useful. We should once again mention the fact FXTM accepts wire transfers from domestic banks in Indonesia and Nigeria, which is incredibly convenient for traders from these countries!

You might be wondering what additional costs these payment methods incur – and while that depends on the payment provider, FXTM covers the costs of deposits. This means that you can pick payment methods like e-wallets and wire transfers that are quite often associated with hefty fees and use them to pay FXTM free of charge! And, of course, you are not bound to make a deposit to start trading – that can be done on one of the demo accounts FXTM has available.

Education

FXTM provides access to a comprehensive educational course. In doing so, FXTM once more affirms it is a global industry leader, as we have long maintained that leading brokerages not only allow their clients to make use of premium trading conditions, but empower them to do so to the best of their ability with various educational videos, articles and webinars, available for free to all of the clients of the broker on its website. Here is what you can expect to find in the FXTM education section:

| Type of educational material | Is it available on FXTM’s website? |

| E-books | Yes |

| Webinars | Yes |

| Articles | Yes |

| Videos | Yes |

All of these tools are quite useful to traders of all skill levels – even veterans can learn something new with them! And if you are looking to get more out of your trading experience, education is the first step of that, as we mentioned.

Conclusion

In summary, there is not a single broker out there that outperforms FXTM. In its stellar trading conditions, in its fair fees and charges and in its powerful trading software, there is a lot to be gained by trading with the broker. If you have read our entire coverage of it, you surely understand why the company ranks so high on a regular basis among traders and industry professionals alike! Here is a brief list of the features that you can expect from the company:

| Strong regulation | FXTM is licensed by the FCA, CySEC and others |

| Fair fees on trading | FXTM is fully transparent and charges symbolic fees commissions and spreads |

| Accessible deposit methods | FXTM accepts a variety of deposits methods from all sorts of payment providers |

| Powerful trading software | FXTM has access to the Metatrader 4 and 5 platforms. |