Trading Accounts

| Account type | Minimum deposit | Leverage | Fee |

| Standard | Undisclosed | None | Max 0.20% |

OKCoin is one of the biggest Bitcoin exchanges, at the time of writing of this review. They focus mainly on the Chinese market and more specifically on retail customers.

The company, security of funds

| Company | Country | Regulation |

| OKCoin.cn Inc | China | N/A |

OKCoin is based in China and also has a second brand. The company has a structure similar to Coinbase and GDAX, one of the brands is focused on the needs of basic customers and the other on more serious traders. OKEX is the name of the more trading oriented solution.

While OKCoin accepts real money transfers, they can only be done in Chinese Yuan (CYN). This is simply the company’s focus, which also carries on to the trading instruments offered (more on them later in the review). That being said, OkCoin used to accept USD deposits, but “issues with intermediary banks” caused the company to cease this activity, much like Bitfinex. Additionally OKCoin stopped accepting US clients, probably because of pressure to comply with US regulators.

While we are on the topic of regulation, we must mention the rather obvious (for some, at least). While China is not strictly against Bitcoin and cryptrocurrencies altogether, the country recently banned ICOs. With that in mind, they may be planning on applying rules on all crypto-transactions, which may affect OKCoin.

OKCoin has not been involved in major hacking scandals so far. The non-Chinese user reviews on the company aren’t that many, but are generally positive, which can’t be said for all cryptio-exchanges.

Trading conditions

Trading instruments (cryptocurrencies)

There are a few altcoins available at OKCoin, but this is definitely not an exchange which list a lot of coins. The options currently available are: BTC, LTC, ETH, ETC and BCC. The addition of Etherem Classic and Bitcoin Cash will be appreciated by some users. Trading at OKCoin is only done against the Chineese Yuan (CNY), while the other brand owned by the company provides more products.

Minimum initial deposit

There is no information on the minimum deposit at OKCoin. This is rather odd, especially given the fact they accept deposits in Yuan. We are used to forex brokers, disclosing their entry barriers. For instance FXCM only requires a $50 deposit, for the opening of a new trading account.

Leverage

Margin trading is not available at OKCoin, while it is at the company’s other brand OKEX. In essence OKCoin is the company which takes fiat currency deposits (only in Yuan), while the other website is the more trader-oriented exchange. Leverage at crypto-exchanges is usually lower than the one provided for forex trading, where brokers often allow 1:500 or even higher ratios. That being said, cryptocurrencies are a lot more volatile, so margin trading is a lot riskier, in general.

Fees

Fees at OKCoin are competitive with the current offers by other brokers, going as high as 0.20%. With greater volumes, the rate declines, which is also a procedure applied by multiple exchanges. Luckily for the more aggressive traders there is no difference for market “makers” and “takers”. The forex brokers who offer bitcoin trading on the other hand include all of their costs in the spread. They also mostly provide CFD trading. For a full comparison of the two types of services read this post.

Trading platform

The platform provided by OKCoin is web-based and a bit simplistic, especially when compared to the one provided by the other brand owned by the company. That being said there are a lot of options, when it comes to charting. Traders can choose between several styles of charts. There are simple ones, the solution provided by trading view, as well as a proprietary solution. Here is a preview:

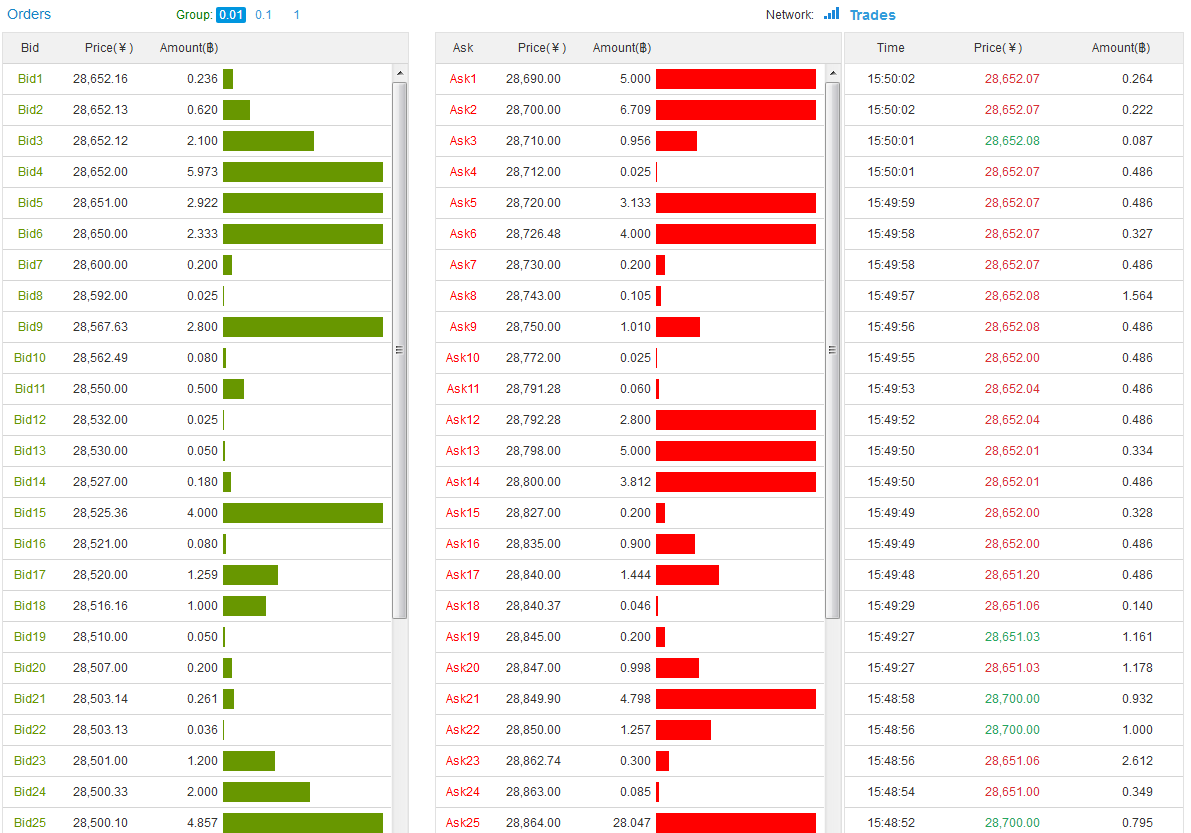

The charting is very nice, with some technical indicators being pre-loaded, to stimulate more active trading. The order book at OKCoin is also very user-friendly. Here is a preview:

One can clearly distinguish between the bids and asks. The tape is also conveniently located to right.

Overall this is a solid platform. The company’s other brand OKEX offers an even more sophisticated solution.

Methods of payment

Money transfers in CNY are accepted at OKCoin. Other than that crypto-currency transfers in BTC LTC ETH ETC and BCC are also accepted. Essentially you can open a wallet for each of the coins and use them to transfer funds.

Conclusion

OKCoin is the largest Chinese cryptocurrency exchange, which is mainly oriented towards the domestic market. The company targets retail customers, while also providing another brand OKEX, for the more sophisticated traders. Trading volumes and liquidity for the major coins are quite high. Here is a summary of the pros and cons:

| Pros | Cons |

| No major hacks yet | Trading against CYN |

| Accepts CNY payments | Few altcoins available |

| Competitive commissions | Does not accept US clients |

| Relatively nice trading platform | |

| Has another brand for sophisticated traders (OKEX) |