TMGM Australia is one of the trading names of world-famous broker TMGM – the company has been widely recognized as an excellent trading partner by thousands of clients in more than 150 countries. It is also the official partner of the Australia Open 2021 tennis competition. One of the main markets TMGM deals on is the Australian one – and, in the review below, we have focused on just that branch of the company.

If you would like to know more about the firm overall, and its operations in other countries, check out the following review of them – and if you would like to know more about TMGM Australia, stick around – we will cover every aspect of the broker that a client should consider before opening an account:

TMGM Australia regulation and safety of funds

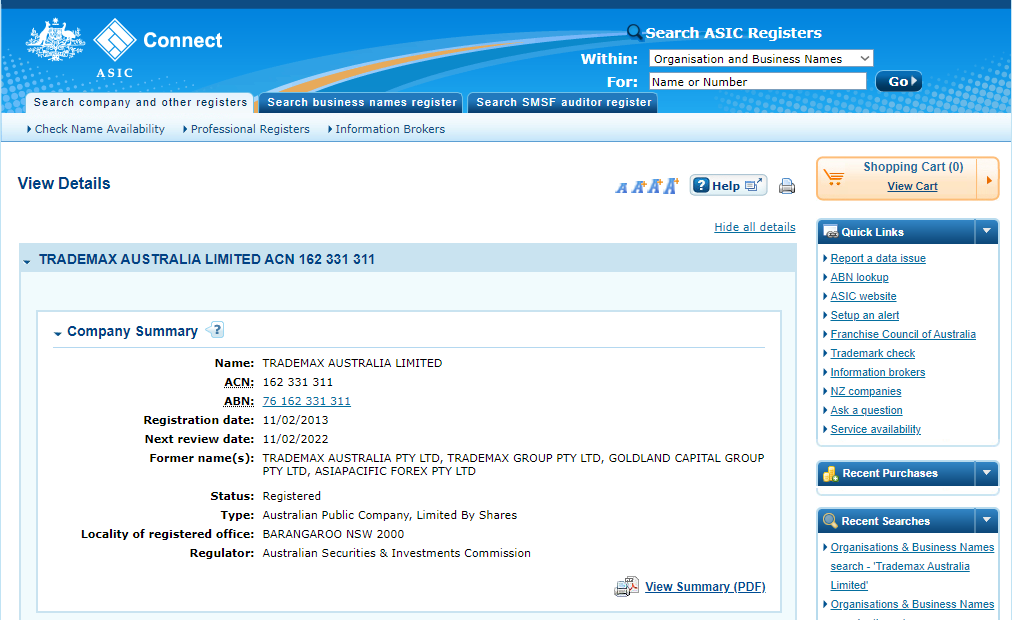

TMGM Australia is regulated by the ASIC – one of the strictest regulatory bodies in Asia. Here is the broker’s claim to that:

Of course, we went and checked the ASIC website to see if we would be able to find the company – and, of course, we did:

All of the details checked out – so there is no doubt about TMGM Australia’s licensing! Here is why trading with legitimate companies, and especially ones overseen by the ASIC is such a good idea:

There are two main dangers to the world of Forex trading nowadays – the abundance of scammers and the volatility of the markets – the ASIC provides clear solutions to both with its policies. To ensure no scammer can run its schemes under the nose of the regulatory body, it has demanded companies under its oversight report transactions on a daily basis to prove they are operating in absolute transparency and to be unable to run any kind of scheme.

And to ensure the safety of funds, the ASIC demands any broker under its watch hold quite a high amount of liquid funds – companies are required to have over 1 million AUD in net capital. What’s more, brokers are required to keep client accounts segregated from their own, which means that if they go under, they will not be able to pay out their debts using client money.

Of course, there are more provisions that the ASIC enforces that could be mentioned – but, hopefully our point has become clear – trading with strictly regulated brokers offers a lot of necessary protections to the retail trader.

TMGM Australia trading conditions

As a licensed broker, TMGM Australia offers access to some excellent trading conditions – with the broker’s two account tiers available below:

The leverage it provides is restricted to 1:30 – this is another result of the ASIC policies designed to protect the retail trader from the volatility of the markets. This kind of trader is usually not properly equipped to deal with it, and engaging in high-leverage trading can wipe out their savings in a couple bad trades. Of course, if you are interested in high-leverage trading, TMGM’s offshore branch, licensed in Vanuatu can provide that – but it would mean waiving other ASIC-enforced protections. At any rate, such trading is only to be engaged in if you are not only well-acquainted with the risks of it, but can mitigate them effectively.

As for the rest of the trading conditions – the broker offers access to some truly competitive spreads – the Edge account has 0 pip fixed spreads, and the ones on the Classic account are fixed at 1 pip. The difference between the accounts is the way they are taxed, with the Edge account being commission-based – more on that later!

TMGM Australia also offers a compelling minimum deposit amount – both accounts have a minimum deposit of $100. And while it is true that other legitimate brokers often have cheaper, micro accounts for $10 at most, they are also most times restricted in the volume they can trade at most. Meanwhile, TMGM Australia’s pricing for a full-fledged account is on the low side – so the broker offers them at a very competitive price!

TMGM Australia trading software

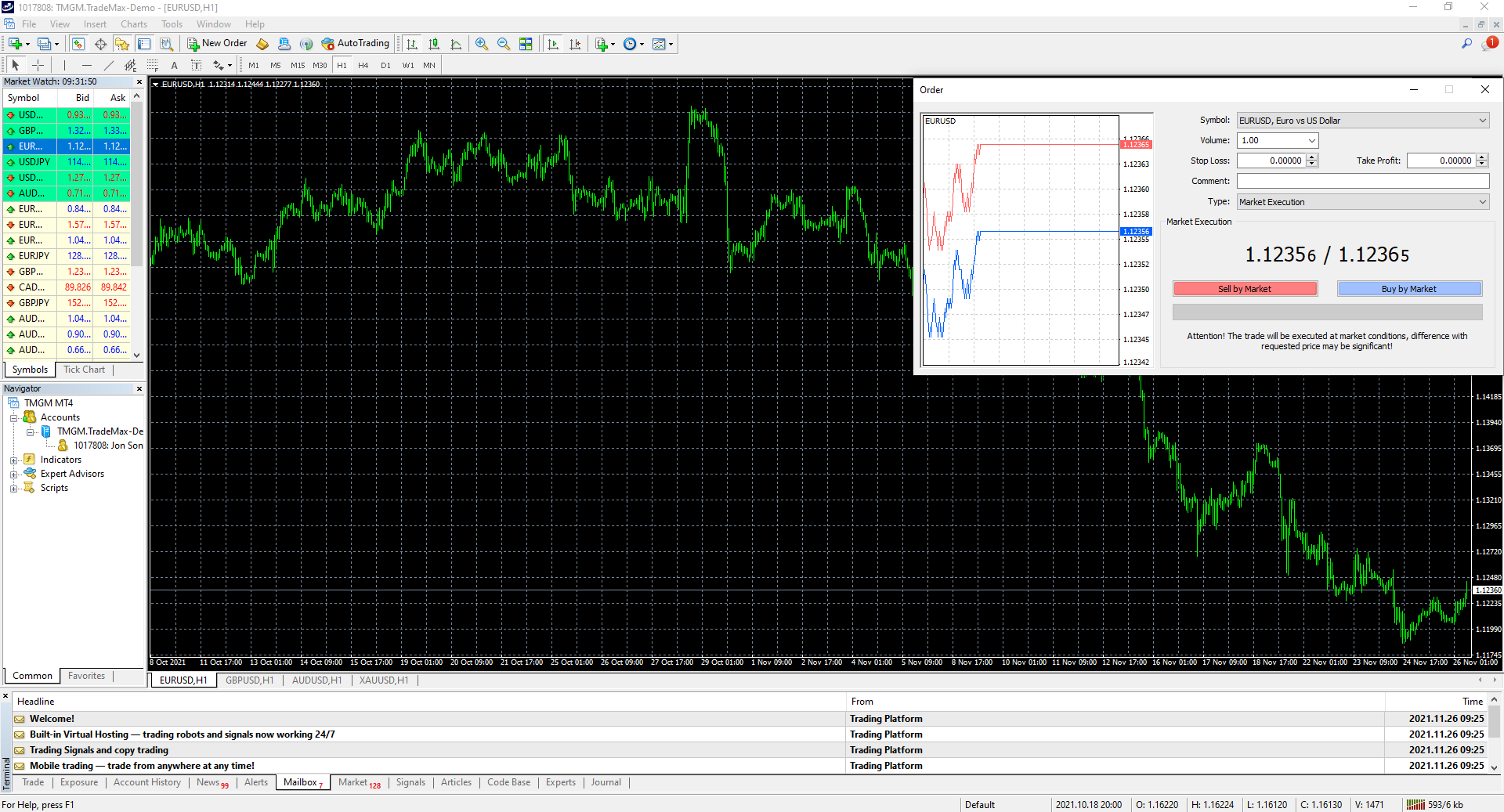

As a leading broker, TMGM Australia offers access to the best trading platforms on the market – Metatrader 4 and 5. The company’s distribution of Metatrader 4 is available for download, while its MT5 client is web-based. Here is what the desktop platform looks like:

The Metatrader platforms have changed the markets – their ease of use, combined with their powerful automated trading features have led to them being the choice of platform for many traders. Metatrader 4 is succeeded by MT5 – a platform that adds more tools of technical analysis. Here is what the platform looks like:

TMGM Australia deposit and withdrawal methods and fees

TMGM Australia accepts deposits via a variety of payment provides – of course, the broker takes MasterCard and Visa, as well as POLi – an Australian debit payment provider. There is also wire transfers available, as well as payments using RMB Instant – another famous online payment tool in Australia.

There are no fees on deposits – what’s more, there are no fees on withdrawals either! This is quite gracious of TMGM Australia – most brokers nowadays waive their fees as a sign of good faith towards their client, but some still charge them. It is good to see TMGM Australia being one of the generous ones.

So, how does the broker make its money? Well, the Edge account is commission based as we mentioned – the commission is $7 per standard lot traded, which is quite fair. The Classic account is commission free, but it does have the 1 pip spread the value of which the broker takes. Whichever way is more comfortable to trade for you, TMGM Australia has got you covered.

TMGM Australia education

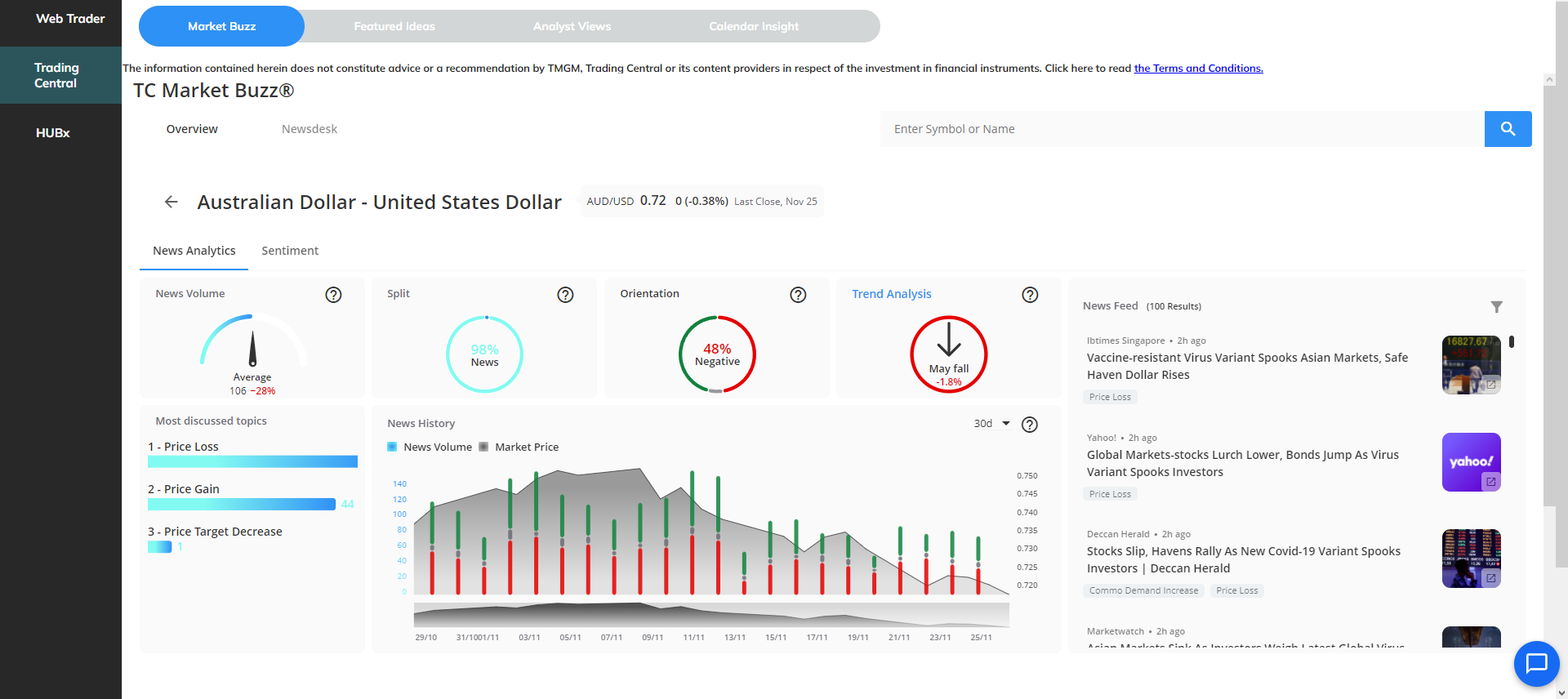

We have long maintained that a good broker goes beyond providing its clients with access to the markets – an exceptional one empowers them to take better decisions on them too. TMGM Australia is no different – the company offers its clients access to a wealth of useful information on the markets, compiled in the Trading Central shown below:

This application allows them to trace the movements of various assets – where they are headed, their current and past market prices as well as review the events that impact them in the News Feed on the right. As you know, the FX markets are fluctuant and their movements reflect world political, social and economic events – TMGM Australia empowers you to be well enough informed to make the best of your trading!

TMGM Australia bonuses and promotions

As of time of writing, TMGM Australia does not really provide any trading bonuses – that is due to its strict regulation. There was a moment in time when scammers would use trading bonuses to restrict clients from withdrawing – they would impose incredible turnover requirements on them and restrict withdrawals until they were achieved, making withdrawals practically impossible. Seeing this, the majority of regulatory bodies out there have banned the provision of such trading incentives. The ASIC is not an exception from that. Better safe than sorry, as they say!

Bottom line

Even though there are thousands of brokers out there nowadays, picking the right one for you is a careful balancing act between the broker’s regulation, its trading conditions and your own appetite for risk. However, with its world-class service and accessibility, TMGM Australia is definitely a strong contender, even when compared to other industry leading brokers. We hope this review has helped you take the choice in broker that is right for you!