XM is a broker that hardly needs an introduction. Since the company’s inception in 2009 it has become among the world’s best brokerages to such an extent it is now almost synonymous with Forex trading.

To date, the company has opened more than ten million accounts for its clients from over 190 countries around the globe! The total amount of trades conducted with the broker has reached over 2,400,000,000 – or two billion and four hundred thousand million. Even wrapping one’s head around such high numbers is difficult – and imagine the total volume of these trades!

The XM Group has not only received the trust of millions of clients from around the world, but also the acclaim of the industry itself, as it has been awarded a number of prestigious awards – just in 2021, the firm received the Ultimate Fintech Best Trading Experience recognition for its services. What’s more, the company has claimed both World Finance’s Best FX broker for Europe and Eurasia. The firm has been winning awards since 2013, and will continue to do so in the future for its excellent service!

However, there is a lot to consider when picking a Forex broker – its regulation, its trading conditions, the various costs associated with trading with it, and so on. In the review below, we have covered all these points of interest. We are quite certain that XM is more than satisfactory on all of them, and that it is one of the best brokers out there nowadays! Let’s start with the company’s regulation

The Company. Regulation and safety of funds

As an industry leader, XM takes regulation quite seriously. There is a whole group of brokers that stands behind the XM brand – and there are four licenses with prestigious regulatory bodies around the world that the company has managed to secure. In this section of the review, we will cover all of them, and also mention the broker’s most notable branches from around the world, covered by us thus far.

Before we begin, however, we would like to provide you with the following table of regulatory bodies that have approved the various XM trading names for the sake of clarity:

| XM Trading Name | Jurisdiction | Regulatory body |

| Trading Point of Financial Instruments Ltd. | The European Union | CySEC |

| Trading Point of Financial Instruments PTY Ltd. | Australia | ASIC |

| XM Global Limited | Belize | FSC |

| Trading Point MENA Limited | Dubai | DFSA |

As you can see, there are four different regulatory frameworks that XM complies with – and, as you can imagine, the regulatory regimes within are quite different. It is quite important to have a good understanding of the regulatory regime you are trading under – that way you can know what protections you are entitled to with a broker! We will examine each one of these regimes and the rules each of the regulatory bodies above impose on brokers, starting with the EU:

XM’s EU license

The XM license with the CySEC is readily available on the website of the regulatory body. Here is what it looks like:

As you can see, it was issues in 2010 – a decade ago! A lot has changed since in the regulatory regime of Cyprus and the EU, and, as you will see, it has rightfully earned its title of one of the strictest regulatory jurisdictions out there.

The first CySEC rule we would like to draw your attention to is the minimum capital requirement of at least €730 000 for brokers. This ensures they have the necessary liquidity to survive the extremely volatile Forex markets. And even if a company does go under, its retail clients will not lose their money! This is because of another CySEC requirement – firms have to keep clients’ funds segregated from their own, so the creditors of the firm cannot touch them in the case of insolvency.

Secondly, there is a further guarantee for the safety of retail client funds in the form of the guarantee funds brokers are required to participate in. Such funds restore up to €20 000 to each affected client in the case of a broker being insolvent, which goes a long way towards recovering their money!

Finally, there is the access to a Negative Balance policy too the EU provides. Understandably, this information might sound confusing if you are not familiar with the regulatory regime of the EU. We have prepared a table below, which will hopefully clarify the various protections you can benefit from when using the services of CySEC licensed brokers:

| Name of protection | Specifics |

| Minimum Capital requirement | Brokers need to hold over €730 000 to prove their solvency |

| Access to guarantee funds | In the case of broker bankruptcy, its retail clients receive up to €20 000 in compensation |

| Account segregation requirement | The broker’s debts cannot be paid from its clients’ funds |

| Access to Negative Balance policy | No retail client can lose more than they have invested with the company |

There is one more thing that is worth mentioning about the regulatory regime in the EU – a license with any of the bodies that oversee the markets of any of the member states qualifies the broker as licensed by any other regulator in the Union. Therefore, whether you are from Germany or Cyprus, Italy or Spain, or any other EU country, XM is one of the best brokers you can invest with!

XM’s license in Australia

The next license of XM we will take a look at is the one the company holds with the Australian Securities and Investments Commission (the ASIC). Once again, the full text of the license is available below:

It was obtained in 2013, which shows that XM has been an active participate in the Australian markets for a long time now. The regulatory regime in Australia has been more permissive than the EU one, with lower restrictions on brokers. However, that has recently changed, and now Australia follows quite a similar regulatory framework. Here is a comparison between the two sets of regulatory requirements:

| Protection | The European Union | Australia |

| Minimum Capital requirement | €730 000 | $1 000 000 AUD (approx. €620 000) |

| Access to Negative Balance policy | Yes, to all retail traders | Yes, to all retail traders |

| Access to guarantee funds | Yes, to retail traders | No |

As you can see, a lot of the same protections are in place – the only major difference is the lack of access to guarantee funds. However, with the tightening regulation in Australia, there is a high possibility of that changing and some kind of compensation scheme being established!

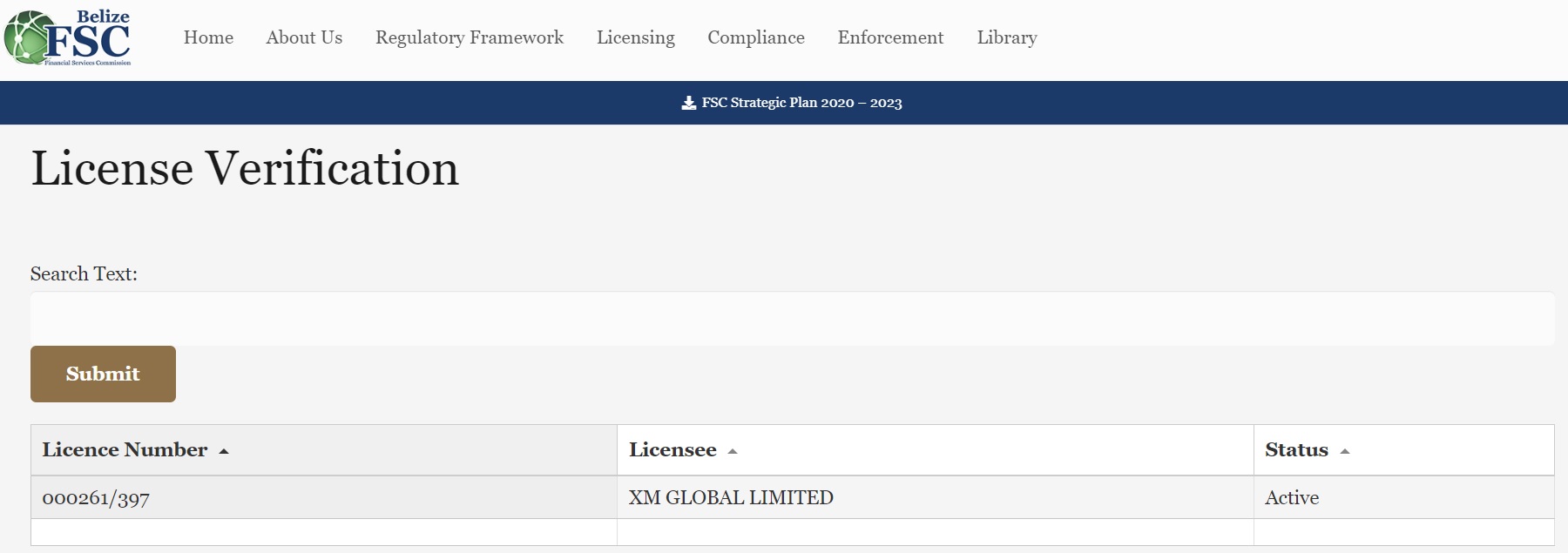

XM’s license from Belize

The next license XM has that we will take a look at is the one from the regulatory body in Belize, the Financial Services Commission (the FSC). Once more, the license the broker holds is available on the website of the regulatory body:

This jurisdiction is technically an offshore country – and such places are infamous for scams. However, the regulatory body there is quite strict and weeds scammers out actively! The regulation there is still looser than the ones in the EU and Australia, but this is also rather beneficial. You see, the restrictions in the EU and Australia also limit the leverage the retail client can access – and they also prohibit the issuing of any kind of bonus or other promotional scheme. Here is a comparison between the three regimes:

| Regulatory measure | The European Union | Australia | Belize |

| Minimum capital requirement | €730 000 | $1 million AUD | $500 000 |

| Negative Balance Policy | Yes | Yes | No |

| Guarantee funds | Yes | No | No |

| Leverage restriction | 1:30 for retail clients | 1:30 for retail clients | Not restricted |

| Access to Bonuses | Not allowed | Not allowed | Allowed |

The issues with offshore brokers that are licensed are the usual concerns on their liquidity – however, no such concerns are available with XM! The plethora of other licenses the company holds ensures its liquidity! So, if you are a bit of an experienced trader, or are looking to make use of XM’s attractive bonuses this is the best branch of the broker for you!

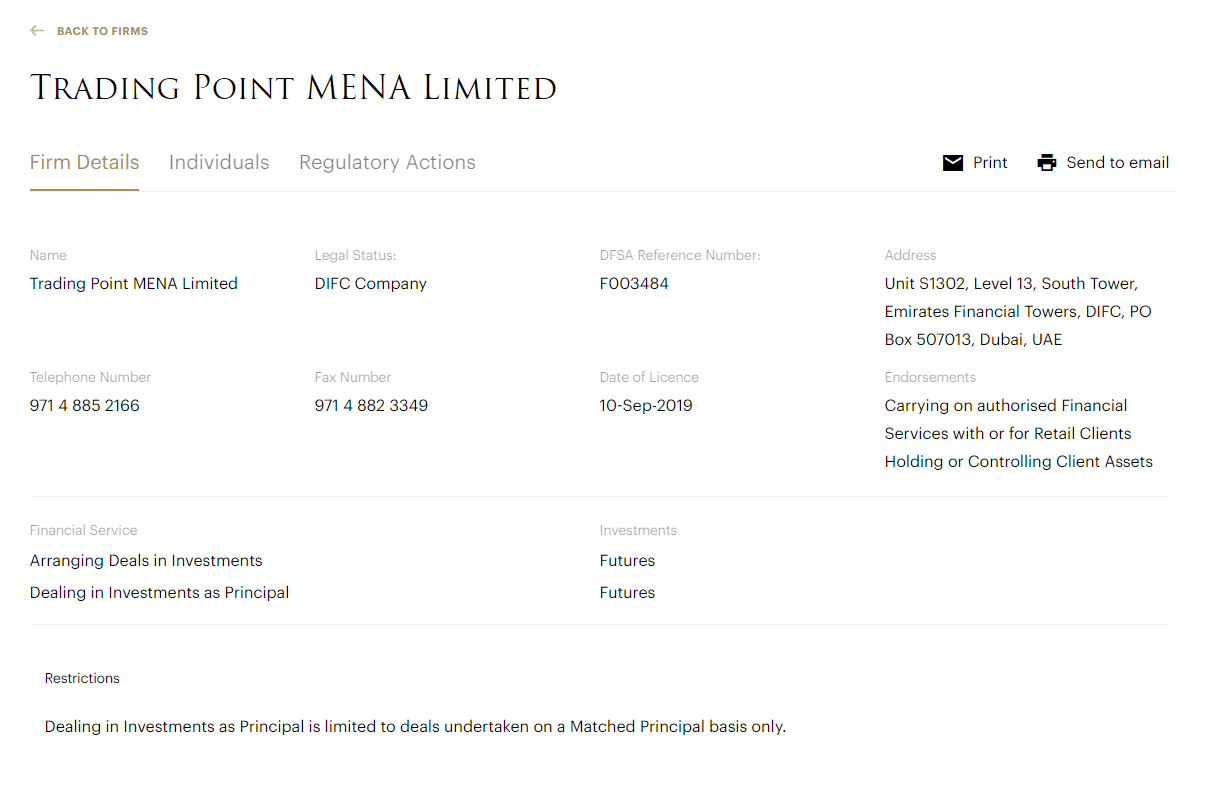

XM’s Dubai license

Finally, we will take a look at the fourth license XM has received, this time from the regulatory body that oversees the markets in Dubai. This body is the Dubai Financial Service Authority (DFSA), which also has an online register where one can easily check to see if a broker is licensed. Of course, as with the other registers, XM was present there, as you can see below:

This is the latest license of the broker, as it was issues in 2019. It is probably not the last, as the industry leading broker goes into new markets!

The regulatory regime in Dubai is a bit different from the one in the rest of the United Arab Emirates. The city is under its own supervision, but the policies the DFSA has put in place are quite similar to the ones the EU and Australia have in place. Here is a comparison between all four regulatory jurisdictions:

| Regulatory measure | The European Union | Australia | Belize | Dubai |

| Minimum capital requirement | €730 000 | $1 million AUD | $500 000 | $500 000 |

| Leverage restriction | 1:30 | 1:30 | Unrestricted | 1:30 |

| Access to bonuses | Not allowed | Not allowed | Allowed | Not allowed |

If you are a trader from the Dubai market, XM is an excellent broker to deposit with – the company is stellar and fully integrated within the regulatory framework of the autonomous zone!

Notable XM branches around the world

XM has several branches from all over the world – all of them are well worth your time or money, but some really stand out with their interesting and unique features. Here are the ones we have covered so far:

XM Global Malaysia

Malaysia is a country which has managed to massively increase its GDP in the past years – ever since the 80s, it has been on the rise with a steady annual increase of between 4-6%. This has made a lot of brokers turn their eyes to Malaysia, which is an emergent market with a lot of potential. XM is no exception, and the company has taken a lot of measures to make sure the Malay trader makes use of not only the best trading conditions, but also of an extensive and Live Education in their domestic language.

As for the regulation of XM Global Malaysia, the broker’s branch there is operated by the trading name of XM Global Limited – the Belize-licensed name of XM. This means the specifics outlined above apply – and that clients in Malaysia can make use of the generous bonuses of the broker, which we elaborate on further on! Therefore, if you are one of these clients, XM Malaysia is an excellent alternative to any other company that might conduct its business on the Malay markets!

Promotions

As noted above, XM has access to some truly excellent promotions for its clients. Do note that only clients of XM Global Limited, or the branch of the broker the Belize regulator oversees can make use of the bonuses. This means that clients from the EU, Australia and Dubai are not within the scope of the traders who can receive the promotional funds. There are good reasons behind the regulatory bodies of the three banning them, of course, as strict regulation has some drawbacks on top of its overwhelming advantages.

With that in mind, here is a brief overview of the various bonuses XM offers at the time of writing:

| Promotion name | Specifics |

| $30 no deposit bonus | Verify your XM account to receive a $30 trading bonus |

| Referral program | Refer friends and family to XM to receive up to $35 per referral |

| Scaling deposit bonus | Receive a 50% bonus on deposits up to $500 and a 20% bonus on ones up to $4500 |

| XM loyalty program | Earn XM points on trades and be eligible for various rewards |

Of course, all of these bonuses come with various Terms and Conditions, which you should get familiar with before accepting one of them. We will now provide a bit of a more in-depth explanation of the various promotional programs of XM:

Firstly, the $30 no deposit bonus is available to any trader who completes their KYC process with XM and verifies their account. This bonus can be immediately used to trade, and the profits from trading with it can be withdrawn at any time. However, the bonus itself is not eligible for a withdrawal and can only be used to open and close positions, allowing the trader to make trades with a higher margin than possible only with their own funds!

Secondly, the referral bonus XM has available is an excellent opportunity to both introduce your friends and family to a stellar brokerage and get rewarded for it. Please note that the bonus becomes available once the introduced person verifies their account and achieves a certain amount of trading volume. As you can imagine, this is done to prevent abuse. The referral bonus can be withdrawn once it becomes available, or it can be used to trade – it’s up to you!

Next, XM’s scaling deposit bonus might sound a bit complex, but it is actually just a deposit bonus with two tiers on it. The first tier is the 50% tier – deposits of up to $500 are eligible to get this bonus, and the second is the 20% tier, available for deposits from $500 to $4500. This way, the maximum deposit bonus you can get from XM is $5000, which is nothing to scoff at!

Finally, the XM loyalty program ensures that high-volume traders are compensated by the broker accordingly – they can earn XM points on each one of their traders, with more points awarded to higher volume trades. These points entitle their recipients to various rewards – one of them is exclusive deposit bonuses that are tailor-made by XM for them.

These promotions are quite lucrative and generous from the broker. The Terms and Conditions for them are also readily available on its website, so you can best decide if accepting one of them is for you. Once more, we urge you to get familiar with that kind of legal documentation – that way, you can see for yourself that these bonuses are transparent and come with no strings attached!

Trading accounts and minimum deposits

XM offers some of the best trading conditions out there – and the broker is also quite flexible in the account tiers that are available with it! They are summed up here, with the benefits each account provides access to explained further below the following table:

| Account features | XM Micro Account | XM Standard Account | XM Zero Account | XM Shares Account | XM Ultra low account |

| Available in | All XM branches | All XM branches | XM EU | XM Global | All XM Branches |

| Contract size | 1 lot = 1000 units | 1 lot = 100 000 units | 1 lot = 100 000 units | 1 share | 1 lot = 1000 units/ 1 lot = 100 000 units |

| Minimum deposit | $5 | $5 | $5 | $10 000 | $5 |

There is a high amount of trading accounts available with XM – so, picking the right one for you is quite easy, based on your appetite for risk and preferred trading mode! As you can see, the XM Micro and Standard Accounts are available in all jurisdictions, with the other three tiers being exclusive to a specific jurisdiction.

Let’s first take a look at the two generally available tiers – the difference between them is the contract size, with the Micro account having access to a contract size of 1000 currency units per lot, and the size of the standard account being 100 000 units per lot. Micro accounts are aimed at newer traders who might wish to test out their strategies in a low-risk environment. This is quite beneficial to them, as it allows them to somewhat lessen the losses they are bound to incur due to their lack of experience. So, we can recommend the Micro account for fledgling traders and the Standard account for experienced clients. The pricing on these account tiers is quite affordable, and both tiers sit at $5 as their minimum deposit. This shows the commitment XM has taken to democratizing the markets and lowering the bar to accessing them. And while $5 is a common minimum deposit for a micro account, standard tiers are usually more expensive, usually within the $100-200 range, so experienced traders will have a very good time with XM too!

On to the more specialized account tiers, starting with the Zero account. This account is designed for the EU client, and it is similar to the Standard account, with the difference between the two being the pricing model of the account. The Standard account is spread-based and the Zero account has fixed spread and a commission – more on that later. Once more, the cost of such an account is $5, which is extremely fair.

Next, the Shares account. This account was designed with professional traders in mind, and it does not provide access to leveraged trading at all. The contract size is 1 share, and the cost to entry is $10 000. If you are a retail trader, this account might not be for you – but XM has a lot of other, better options, as you can see. One last thing before we move to the next account tier, the Shares account is available to clients of the Belize-licensed branch of XM exclusively.

Finally, the Australian Ultra Low account, exclusive to traders of the XM branch overseen by the ASIC provides access to a very interesting set of trading conditions. As you can see, there are two different contract sizes specified – that is no mistake. The account tier allows the client to specify their preferred contract size. It also comes with a lower minimum spread then the Standard account and the Micro account tiers. It seems the Ultra Low account is the best pick for clients who are eligible to trade with it, and the cost of entry is once more only $5!

Trading conditions: Leverage, spreads and commissions

As you can imagine from the various account tiers the broker provides access to, its trading conditions are also quite varied – the broker’s leverage, spreads and commissions are discussed in a lot of detail below, starting with the company’s policies on leverage:

Leverage

We have already mentioned that Australia, the EU and Dubai restrict the leverage available to retail clients to up to 1:30. This is a wonderful policy, as it prohibits these clients from dealing with high amounts of leverage they are not equipped to handle. Still, there is a way for the trader in these jurisdictions to make use of higher amounts. This is by them being classified as, or self-classifying as a professional trader. The requirements for that status are dependent on the jurisdiction in question. For example, in the EU, to be classified as a professional client, you need to have either over a year working at a financial institution, or a certain portfolio size – over $500 000. And to become a professional client after being classified as a retail one, you need to have the same portfolio size and a trading volume of at least 10 lots per year, with lots meaning 100 000 units of base currency in this case.

Once you are classified with the broker, you will lose access to some protections – access to a Negative Balance policy and recovery funds, but gain access to the maximum amount of leverage XM has available – 1:1000. Please note that the broker has its own internal set of rules regarding leverage – the higher the volume of the trade, the lower the maximum leverage allowed on it. Here is a handy table that clarifies that policy:

| Trade size | Allowed leverage |

| $5 – $40,000 | 1:1 to :1000 |

| $40,001 – $80,000 | 1:1 to 1:500 |

| $80,001 – $200,000 | 1:1 to 1:200 |

| $200,001+ | 1:1 to 1:100 |

This is a rather responsible policy that aims to protect the client from the volatile markets – so it makes sense for the broker to have it in place!

Let’s take a look at the costs associated with trading with the broker too:

Spreads and Commissions

Brokers nowadays make their money in one of two ways – they charge the value of the spread when a trade is open or take a commission on each trade. Of course, some brokers have both pricing methods available – but XM does not. Additionally, the spreads of the broker are quite acceptable too – here is a table outlining what account tier has what spread values:

| Account tier | Micro Account | Standard Account | Zero Account | Shares Account | Ultra Low Account |

| Spread | From 1 pip | From 1 pip | From 0 pips | From 1 pip | From 0.6 pips |

None of these account tiers charge any commissions, except for the Zero account. That account has spreads as low as 0 pips, and so the broker charges a commission on it. That commission is $3.5 on opening or closing a trade, or “per side”. This is a rather low amount of money to pay, making the Zero account perfect for traders who enjoy low spreads. But even if you prefer to pay the value of the spreads instead, they are quite low with XM – spreads of 1 pip are considered to be the acceptable amount for FX majors like the EURUSD nowadays!

Trading platforms

As an industry standard broker, XM cannot offer anything but the industry standard when it comes to its trading software! The broker has its clients pick between the Metatrader 4 and 5 platforms, which are widely regarded as the best on today’s market. Let’s explore said platforms, starting with XM’s distribution of MT5:

The Metatrader platform is famous for its clean interface, its plethora of analytical tools and its powerful automated trading options. This trading can be done using Expert Advisers – trading bots, which are bought and sold on the marketplace that comes with the platform. The main difference between the two platforms is that there is no Shares CFDs trading allowed on MT4 – but the older software has everything else you could expect from a distribution of the platform. In fact, to date, MT4 still has more users than its successor!

XM also provides access to two web-based platforms, for the trader on the go. They are web versions of the MT platforms – here is the one that corresponds to MT5:

Free VPS

In addition to having the platforms available to all of its clients, XM also offers a certain subset of them a VPS service for free. This service allows the trader to make use of auto-trading bots (a.k.a Expert Advisors) and to not have to worry about downtime on their trading.

Clients who maintain a minimum trading account balance of 500 USD, or equivalent in other currencies, are eligible to request for free VPS from the Members Area at any given time, on condition that they trade at least 2 standard round turn lots or 200 micro round turn lots per month.

The service is available with a lot of brokers, and usually provided at the cost of a monthly subscription – however, XM is an exceptional broker, and, as such, offers clients that meet the above requirements to make use of the service for free! VPS eligibility rules depend on the XM entity.

Deposit and withdrawal methods and fees

XM is a broker that puts the convenience of its client first – and it has therefore elected to make use of various deposit methods. Clients are free to deposit using conventional methods like credit cards and wire transfers, and some less conventional ones too. For example, the Neteller and Skrill e-wallets are eligible deposit methods with XM! The broker also has a policy that makes deposits made using any one of the methods it takes completely free of change. This means you can use whichever method you prefer. Here is a summary of XM’s accepted payment methods:

| Payment method | Accepted by XM? | Charges |

| Visa/Mastercard payments | Yes | Free of charge |

| China Union Pay | Yes | Free of charge |

| E-wallets – Neteller, Skrill and others | Yes | Free of charge |

| Wire transfers | Yes | Free of charge |

And when it comes to withdrawals, the same policy applies – the broker not only charges no fees on withdrawals, but actively covers the costs of payment providers themselves for you!

*Bank wire fees are covered for withdrawals above USD 200

Education

We have long maintained that a good broker is one that is not only able to provide an excellent service, but also one that can do so while empowering its clients to make use of its services in the best way possible for them. This is achieved by brokers by them providing access to education programs. One is available on XM’s website too – and between the hundreds of articles, videos and access to XM Live, the broker truly lives up to our expectations!

XM Live is a rather unique service, which allows any client to tune into one of the webinars the broker has live around the clock. These webinars are hosted by various industry professionals and are quite useful to clients of all skill levels – even experienced traders can learn a lot from them! Here is what the broker has to say about the XM Live service:

What’s more, we should once more mention the Live Education in Malay XM hosts – it is available to clients from the country at their native language, making them much easier to digest!

All of these educational materials are completely free too – so they are designed to be maximally beneficial to all clients! Here is what kind of information one might find on the XM website:

| Educational material | Available on XM? |

| Webinars | Yes |

| Articles | Yes |

| Videos | Yes |