It’s not hard to guess that something is wrong with Hexmarkets.com since the domain leads directly to a trading platform interface. There is no normal website where we can see the legal information and documentation of this broker, inform ourselves about the offered trading conditions and other basic details that are expected from a legitimate business. But since hexmarkets.com is online and functional, then it is good to explain to people without enough experience and knowledge about financial trading why they should not trust their money to such a strange and suspicious broker.

Hexmarkets Regulation

| Guaranteed Funds | Segregated Accounts | Negative balance protection | |

| Hexmarkets | ❌ | ❌ | ❌ |

| UK regulated brokers | £85 000 | Yes | Yes |

| EU regulated brokers | €20 000 | Yes | Yes |

| AU regulated brokers | No | Yes | Yes |

| US regulted brokers | Yes | Yes | No |

As has been pointed out, hexmarkets does not have a normal website from which to inform ourselves who we are dealing with. Nowhere do we find Terms and Conditions and other legal documentation. The company hexmarkets Llc is mentioned, but nowhere is it stated where it is based or what regulatory regime it is subject to. We have no good reason to believe that this legal entity actually exists.

When you visit the website of a legitimate broker you can expect to find clear and detailed information about the company that owns and operates it, where it is based and what regulatory regimes it is subject to. Licensed financial services providers are also required to provide a comprehensive set of legal documentation. The availability of such information does not guarantee that it is not false or misleading, which is why you should always do careful fact-checking. But the absence of these elements is very indicative that in all likelihood you are dealing with scammers.

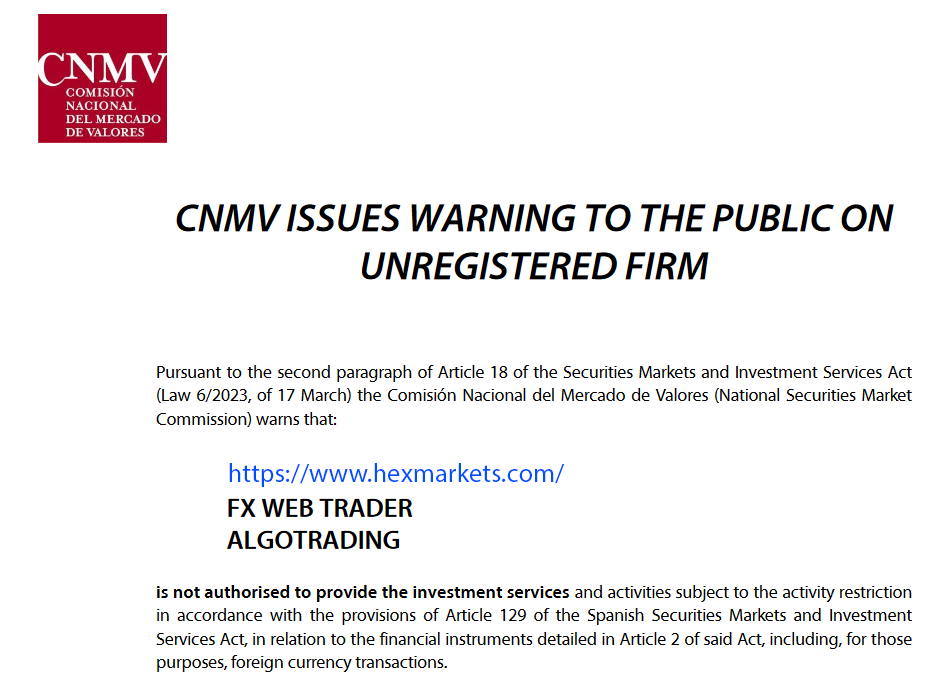

The Spanish financial regulator CNMV has also spotted this suspicious broker and issued a warning to investors that this is not a licensed financial services provider.

You should only trust legitimate brokers operating in one of the established financial centres like the UK, EU, USA or Australia. There, the activities of brokers are controlled by powerful regulatory bodies such as UK’s Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Commodity Futures Trading Commission (CFTC) in US or Australian Securities and Investments Commission (ASIC). Clients of these brokers receive protections such as negative balance protection and segregation of the client’s funds from the broker’s funds.

In the EU and the UK, brokers must also participate in guarantee schemes that cover a certain amount of the trader’s investment if the broker becomes insolvent. These guarantees amount to up to 20 000 EUR in the EU and 85 000 GBP in the UK. However, the likelihood of such a bankruptcy is low because regulators also have significant net capital requirements that companies must maintain – EUR 730 000 in UK and Cyprus, AUD 1000 000 in Australia and at least 20 million USD in the United States.

Hexmarkets Trading platform

| Advanced tools | Auto trading | Custom indicators | Mobile versions | |

| Hexmarkets platform | ✅ | ❌ | ✅ | ❌ |

| MT4 | 30+ indicators | ✅ | ✅ | Android and iOS |

| MT5 | 50+ indicators | ✅ | ✅ | Android and iOS |

| cTrader | 40+ indicators | ✅ | ✅ | Android and iOS |

The hexmarkets trading platform itself is standard and offers the basic functionality for placing orders. But it lacks the more advanced functionality found in the most widely used trading platforms in the industry, MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms have established themselves as industry standard because they offer a wide range of features, including a variety of options for customization, multiple account usage, designing and implementing custom scripts for automated trading and backtesting trade strategies.

It should be noted that the presence of a trading platform does not make this website any more legitimate and does not guarantee that this alleged broker offers real trading. Many scammers use rigged trading software to fool their victims that their money is being invested.

hexmarkets Minimum deposit

| hexmarkets | FP Markets | XM | HFM | |

| Minimum deposit | $50 | $100 | $5 | $0 |

The leading brands in the industry offer beginner traders starter accounts with a very low minimum deposit. You have no good reason to take chances with shady brokers like hexmarkets.

hexmarkets.com Payment methods

| Deposit time | Withdrawal time | Price | |

| Bank wire | 2-5 business days | 5-10 business days | $25+ |

| Credit card | Instant | 24 hours | Free |

| PayPal | 1 hour | 24 hours | 2% |

| Skrill | 1 hour | 24 hours | 2% |

| Neteller | 1 hour | 24 hours | 2% |

| Crypto | 24 hours | 24 hours | Fee depends on crypto |

In the deposit menu we only see the option to transfer via credit/debit card. But when attempting to deposit, hexmarkets actually transfers to fishy platforms for purchasing cryptocurrencies like crypto-trinity.com.

Scammers prefer cryptocurrencies because these transactions are not subject to refunds. While there are some legitimate brokers that accept digital currencies like Bitcoin, they do so alongside other transparent payment methods such as credit/debit card, bank transfer or popular e-wallets like PayPal, Neteller or Skrill.

hexmarkets Trading Instruments

| Currency | Stocks | Indices | Crypto | Commodities | |

| hexmarkets.com | Yes | Yes | Yes | Yes | Yes |

| FP Markets | Yes | Yes | Yes | Yes | Yes |

| XM | Yes | Yes | Yes | Yes | Yes |

| HFM | Yes | Yes | Yes | Yes | Yes |

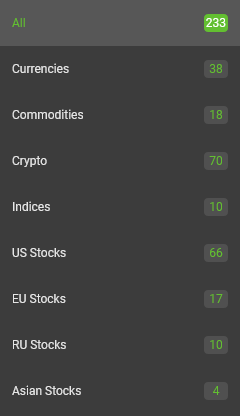

hexmarkets trading software includes over 200 financial instruments, including 70 cryptocurrencies. But as already stated, there is no reason to believe that the trading offered by this shady broker is real.

hexmarkets Spread

| hexmarkets | FP Markets | XM | HFM | |

| Spread EURUSD | 1 | 1.0 | 1.1 | 0.9 |

| Spread GBPUSD | 1 | 1.2 | 1.3 | 1.2 |

| Spread USDJPY | 1 | 1.2 | 1.3 | 1.1 |

In the trading platform we see a spread of 1 pip, which in itself is a competitive level. But besides the fact that the trade offered by hexmarkets is undoubtedly fictitious, we do not know if this broker charges additional fees and commissions.

hexmarkets Leverage

| Currency | Stocks | Crypto | Gold | Indices | |

| Hexmarkets | 500:1 | 500:1 | 500:1 | 500:1 | 500:1 |

| UK regulated brokers | 30:1 | 5:1 | ❌ | 20:1 | 20:1 |

| EU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| AU regulated brokers | 30:1 | 5:1 | 2:1 | 20:1 | 20:1 |

| US regulated brokers | 50:1 | ❌ | ❌ | ❌ | ❌ |

A high leverage ratio of 1:500 is set in the hexmarkets trading platform. This is not a level that you see with regulated brokers. Trading with high leverage allows higher profits, but also increases the risk of sudden and excessive losses proportionally. All leading regulators limit leverage for retail traders. In the EU, UK and Australia the maximum permitted level is 1:30 and in the US it is 1:50. This maximum level only applies to trading major currency pairs, with even more limited leverage for more volatile assets.

Hexmarkets Withdrawal requirements

| Trading volume requirement | Fee/Tax on withdrawal | Minimum withdrawal | |

| Hexmarkets | Not specified | Not specified | Not specified |

| UK regulated brokers | No | No | No |

| EU regulated brokers | No | No | No |

| AU regulated brokers | No | No | No |

| US regulated brokers | No | No | No |

The lack of a publicly available Terms and Conditions or Client Agreement means that scammers may have set many traps such as hidden fees and impossible-to-meet withdrawal terms.

Hexmarkets Pros and Cons

| Pros | Cons |

| Notning to mention | Unregulated |

| No legal documentatios | |

| Blacklisted by the CNMV | |

| Risky leverage ratios | |

Over a month ago I lost $378000 to a fake trading company when i wanted to make a withdrawal from my trading account my account manager keep asking me to pay more fees to enable me withdraw my capital money and my profits, I was stressed out and frustrated at that moment couldn’t find legit help anywhere. Lucky enough I got referred to a lady called Trish flora who helped me to recover all my funds and also guide me on how to make a successful withdrawal, this lady is a genius she recovered the full amount which got me speechless God bless you trish flora greetings from Florida!!! You can also send a direct message via her personal gmail address ([email protected]) contact her she can also help you out

I had the unfortunate experience of falling victim to a scam, I was convinced with their bonus promises by their brokers/fund managers. My account had reached up to $100,000 in May, however when I told them about my intent to withdraw my account suddenly it went down and bonuses vanished. For months I was not able to make a withdrawal but thankfully I came across Mrs. Charlotte Scott with their professional assistance, I was able to track down the scammers and ensure that my deposits and profits were restored. I can’t express how grateful I am for their expertise and dedication in helping innocent people like me who have been swindled. If you find yourself in a similar situation, I highly recommend reaching out to these guys for their reliable assistance.

You can contact her via

email: charlotte…scotte….24….@…..gmail…..com

WhatsApp: +1–(330)519–2440

i was a victim of this scam last 2 months but with the assistance of fastrecoverychannel @ mail . com i was able to recover my money